As a growth investor can you use the Piotroski F-Score to increase your returns? That is what a friend of mine set out to test in an interesting research paper called Utility of Piotroski F-Score for Predicting Growth Stock Returns.

In the paper he looked at:

- Can the Piotroski F-Score increase the returns of a growth investment strategy?

- What are the structural differences between growth and value investing?

- How large is the improvement in returns the use of the Piotroski F-Score can give growth investors.

- The success of a long-short strategy that buys high F-Score (good) companies and shorts low F-Score (bad) growth companies?

- Practical ideas of how you can get the return benefit between high and low Piotroski F-Score growth companies.

Astounding results

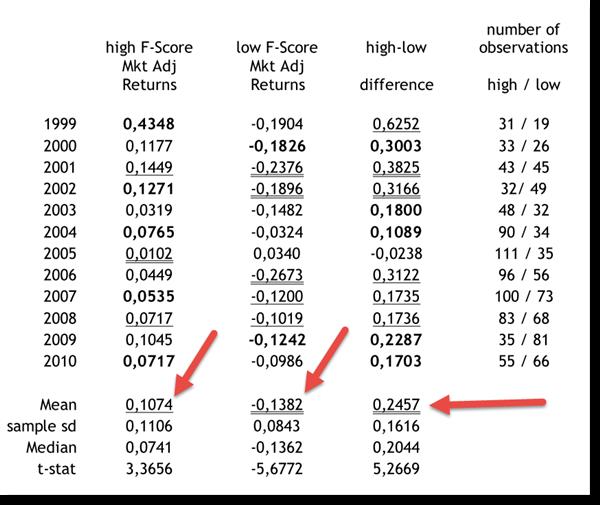

The table below shows the results of the study:

24.57% higher returns

As you can see there is a huge benefit to growth investors of using the Piotroski F-Score.

Over the 12 year period High Piotroski F-Score companies (high quality companies) generated an average return of 10.74% whereas low Piotroski F-Score companies (low quality companies) generated a return of -13.82%.

The difference in the average return was an astounding 24.57%

Download Link

Here is the download link of the research paper: Utility of Piotroski F-Score for Predicting Growth Stock Returns.

Your Piotroski research analyst

P.S. Here is another interesting article on the Piotroski F-Score: Can the Piotroski F-Score also improve your investment strategy?