If you found this article you have most likely heard of the Value Composite One investment strategy developed by James O’Shaughnessy and mentioned in his excellent book What Works on Wall Street.

In this article I will show you why it’s a great investment strategy and exactly how (step by step) you can implement it in your portfolio.

First a bit of background information.

I am sure you have also seen too many back tested investment strategies that showed that low price to book or low price to earnings ratio stocks outperformed the market over long periods of time.

Multiple ratios give you better returns over 80% of the time

But do you know that if you look for undervalued companies based on a number of different valuation ratios you get higher returns compared to if you use only one ratio?

James O’Shaughnessy tested and proved this in What Works on Wall Street.

He found that companies selected based on a number of valuation measurements outperformed companies undervalued on any single valuation ratio 82% of the time.

If you think about it this makes a lot of sense.

If you only use the price to book ratio to find ideas you may find a lot of great investments after a big market correction but a lot of bad quality businesses when the markets are not cheap.

Also if you only use the price to book ratio you will completely ignore companies that are cheap based on free cash flow, price to earnings or earnings yield (EBIT/EV).

The answer - a combination of ratios

The answer to this problem is to use one valuation indicator that combines a number of valuation ratios that let you find undervalued companies from different points of view. For example book value, cash flow, net profit and operating profit.

Already done for you

Luckily James already developed a combination of valuation ratios for us and tested it to make sure it can give you market beating returns.

He tested this valuation ranking for all 10-year rolling periods over the 45 year period between 1964 and 2009 and found that it outperformed companies undervalued on any single valuation ratio 82% of the time.

It’s called Value Composite One

James called his collection of valuation ratios Value Composite One (VC1) and it is calculated using the following five valuation ratios:

- Price to book value

- Price to sales

- Earnings before interest, taxes, depreciation and amortization (EBITDA) to Enterprise value (EV)

- Price to cash flow

- Price to earnings

How is the value Composite One ranking calculated?

Just how is the VC1 ranking of a company calculated you may be thinking?

It is really quite easy.

You have to rank each company against all other companies based on every one of the five valuation ratios and then calculate a combined ranking for the company.

In the Quant Investing stock screener we make it easy for you to understand as we give each company a percentile ranking (1 to 100) for each of the five valuation ratios.

To get the combined VC1 rank these five values are added together and the VC1 ranking of the companies are then grouped by percentile ranking with the 1% best ranked companies getting a value of 1 the next 1% of companies a value of 2 and so on.

For example if a company has a price to sales ratio that is in the lowest one percent for all the companies in the database, it gets a price to sales rank of 1 (lower is more undervalued) and if a company has a PE ratio in the highest one percent (it is overvalued) of all the companies in the database it will get a PE rank of 100.

If a value is missing, because a company made losses and no price earnings ratio is available we give it a neutral value of 50 for that ratio.

Once all the companies have been ranked on all valuation ratios you add up all the values (of the 5 valuation ratios) for each company and rank all the companies in percentiles (from 1 to 100) on this one combined ranking.

Undervalued = 1 and overvalued = 100

In the screener this means companies that are the most undervalued have aVC1 rank of 1 those with the worst score (most expensive or overvalued company) get a rank of 100.

Does it give you higher returns? - 46 year back test

What did James find when he tested Value Composite One?

In the blogpost The Value of Value Factors James showed the results of a 46 year back test from 1963 to 2009 where he compared the returns of composite ratios to single valuation ratios.

It worked very well as you can see from the following two charts:

Source: The Value of Value Factors

Source: The Value of Value Factors

As you can see the returns if you invested in cheap and expensive companies based on a number of single valuation ratios were lot lower than the three composite valuation ratios James developed: Value Composite 1, 2 and 3.

Investing in expensive companies is a bad idea

What you can also very clearly see is that investing in expensive companies, irrespective of what ratio you use, it is a bad idea, a VERY bad idea.

Our 12 year back test...

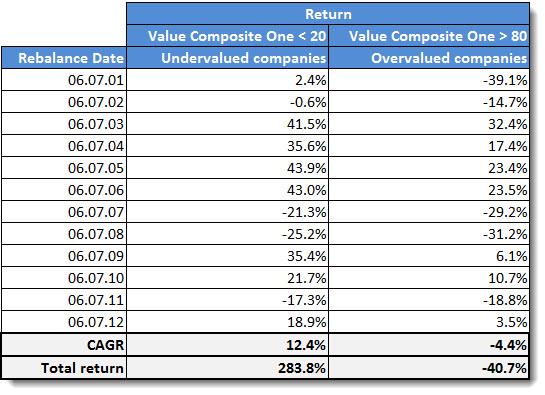

As with most of the strategies in the screener (remember we use the screener for our own investments) we have back tested the returns you could have made if you used the Value Composite One (VC1) indicator as an investment strategy for the 12 years between June 2001 and June 2012.

Total return of 283%, market only 73%

If over this period you bought non-financial companies (in Europe EU, the UK, Switzerland and Scandinavia) with the VC1 value of less than 20 (the 20% most undervalued companies) you would have earned a respectable 12.4% per year or 283% in total.

This compares very well to the 4.9% per year or 73% of all the companies (effectively the market) we tested.

If you only bough expensive companies?

We also tested what would have happened if you only bought companies with a Value Composite 1 value of more than 80, in other words the 20% most expensive companies.

Over the same 12 year period from June 2001 to June 2012 you would have lost 4.4% per year for a total loss of 40.7% over 12 years.

Results summarised

CAGR = Compound annual growth rate (Index return = 4.9% per year and 73% over the 12 year period)

If you want even higher returns look here

That we did not test (it's a future project) is what returns you could have earned if you combined the Value Composite One with another factor like the top 20% of companies in terms of 6 month Price Index or the Piotroski F-score for example.

It is very likely that your returns will be substantially higher as you saw with the two factor strategies we tested in the research paper Quantitative Value Investing in Europe: What works for achieving alpha.

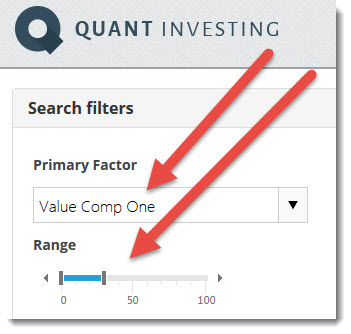

Where to find it in the screener

You can easily find undervalued companies using the Value Composite One indicator with the screener.

Simply use it as a primary screening factor as shown below:

Slider makes it easy

The slider allows you to easily select the range of Value Composite One value companies you want, cheapest 30% in the above screenshot.

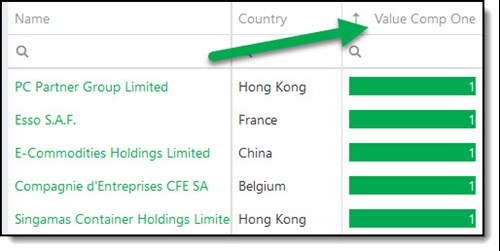

Sort by Value Composite One

You can also sort any screen you run by the Value Composite One ranking as shown below:

It’s as simple as that

That is all there is to it.

It is as simple as this to get the Value Composite One ranking system working in your portfolio.

PS Everything you need to implement this investment strategy in your portfolio can be found here.

PPS Why not sign up right now while it is still fresh in your mind. You can cancel at any time for a FULL refund if you are not happy. Sign up here.