After the shake out this year so far I thought you would be interested to see what companies have lost more than 50% over the past 12 months. Perhaps you can find a few good deep value investment ideas for your portfolio.

What the screen looks like

This is what I screened for:

- All companies in the Quant Investing stock screener's 22,000 company universe

- Market value over $100 million

- Daily average traded value over $100,00

- With a one year stock price decline of more than 50% (to do this I used Price index 12m = Current stock price / stock price 12 months ago)

- Sorted with companies with the biggest fall at the top

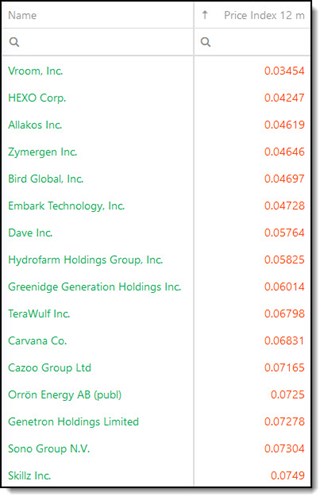

These were companies with the biggest price fall:

As you can see some very wild stock price falls of over 94%!

Click here to start finding your own Deep Value ideas NOW!

Adding good fundamental momentum

This list most likely has a lot of companies that are not going to survive the next 12 months so we have to narrow this down a bit.

So what happens if we only look for companies with good fundamental momentum?

To do this I used the same screen as above but screened out companies with a Piotroski F-Score lower than 6.

The F-Score is a great ratio you can use to quickly screen out low quality companies. You can read more about the Piotroski F-Score here:

Can the Piotroski F-Score also improve your investment strategy?

This academic can help you make better investment decisions – Piotroski F-Score

Use the Piotroski F-Score to seriously improve your returns

How to increase your returns on average 210.6% (max 363.0%) – Piotroski F-Score

Ever thought of using a fundamental stop-loss?

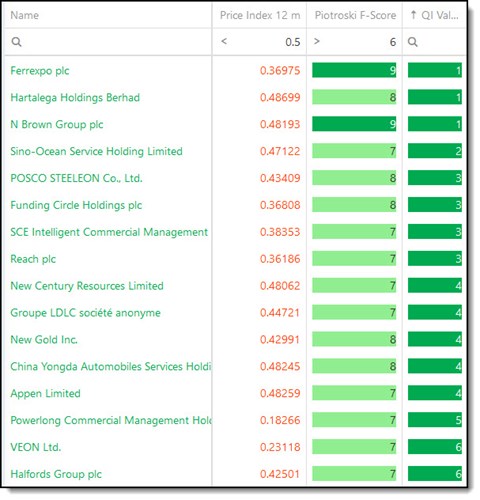

This is what the list of companies now looks like:

Less extreme price falls but still high. But at least the list now has higher quality companies.

Click here to start finding your own Deep Value ideas NOW!

Only look for cheap companies

So far we have not looked at valuation. This is what happens if you only look for undervalued companies.

To do this I used all the above mentioned criteria and sorted the list of companies using our own developed composite rating called Qi Value.

It is a great valuation ratio that I use in my own portfolio. Make sure you read more about it here:

This investment strategy is working even better than we expected +711%

This outperforms all other valuation ratios (14 year back test result)

This is what the list of companies look like now:

Now the list is starting to look interesting, showing you quality cheap companies that have fallen over 50% over the past 12 months.

Click here to start finding your own Deep Value ideas NOW!

Please do your own research

As with all screens this is just a list of companies that because of the large price fall may have VERY BIG problems.

Therefore do your own research and fact checking.

Your deep value analyst wishing you profitable investing

PS To get this deep value investment strategy working in your portfolio right now click here

PPS Why not sign up right now before it slips your mind?